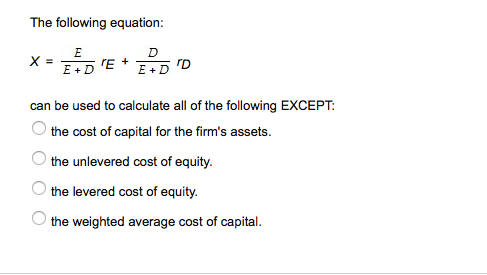

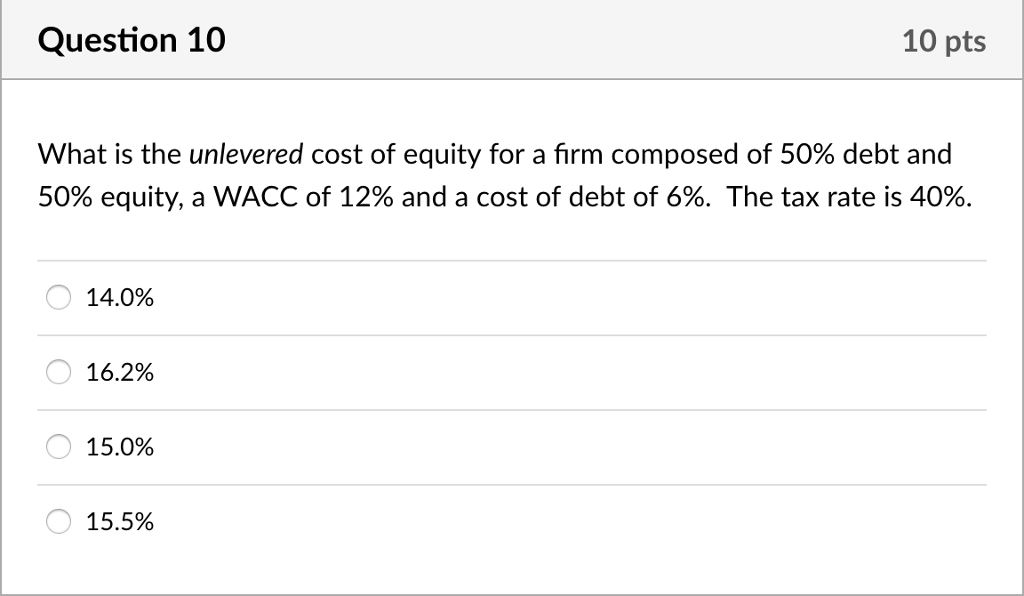

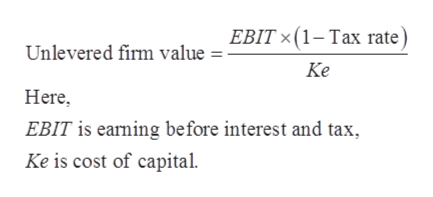

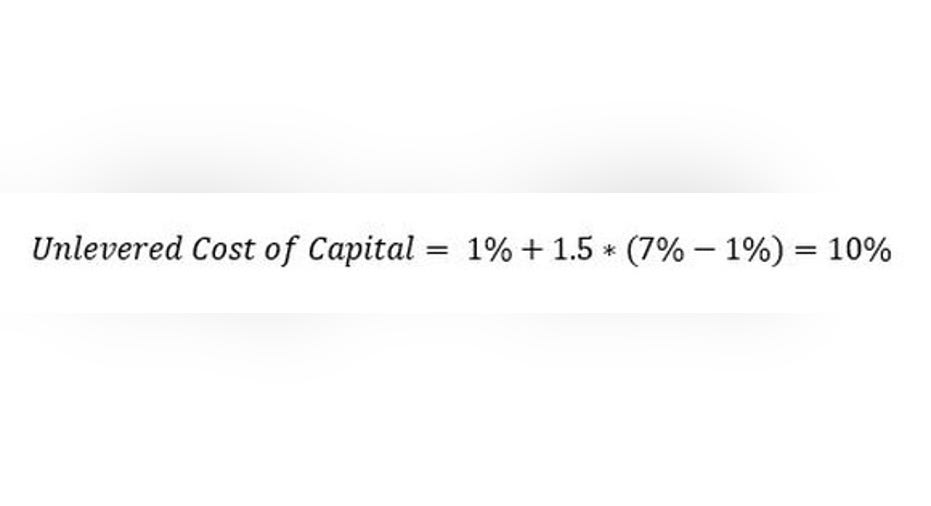

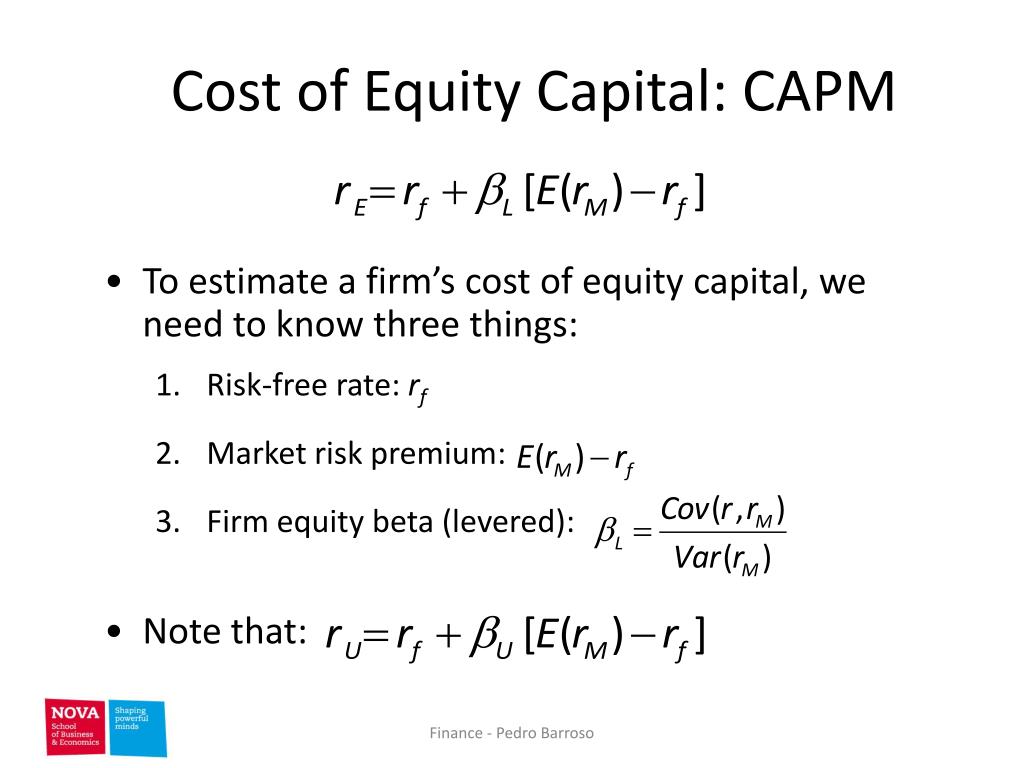

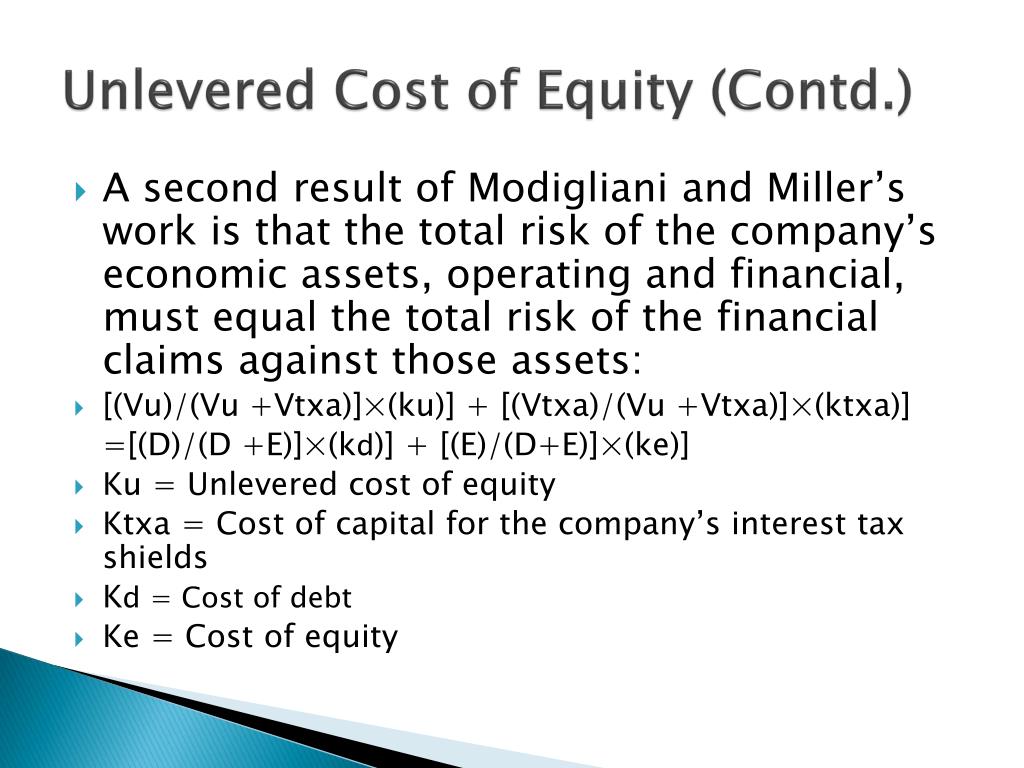

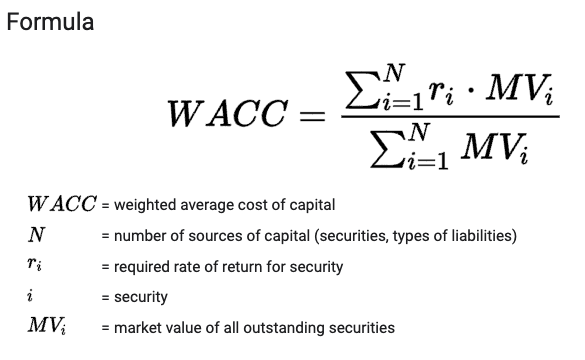

Weston Industries has a debt equity ratio of 1.5. Its WACC is 11 percent, and its cost of debt is 7 percent. The corporate tax rate is 35 percent. i. What is

PPT - Capital Structure Valuation and Capital Budgeting with Debt PowerPoint Presentation - ID:4686737

Twice Shy Industries has a debt-equity ratio of 1.5. Its WACC is 7.9 percent, and its cost of debt is 6.8 percent. The corporate tax rate is 35 percent. a. What is

:max_bytes(150000):strip_icc()/COST-OF-CAPITAL-FINAL-fd03399040114d22a1035a573e672ecb.jpg)